Cy Creek Bank Trading

Trade crypto without the trade-offs

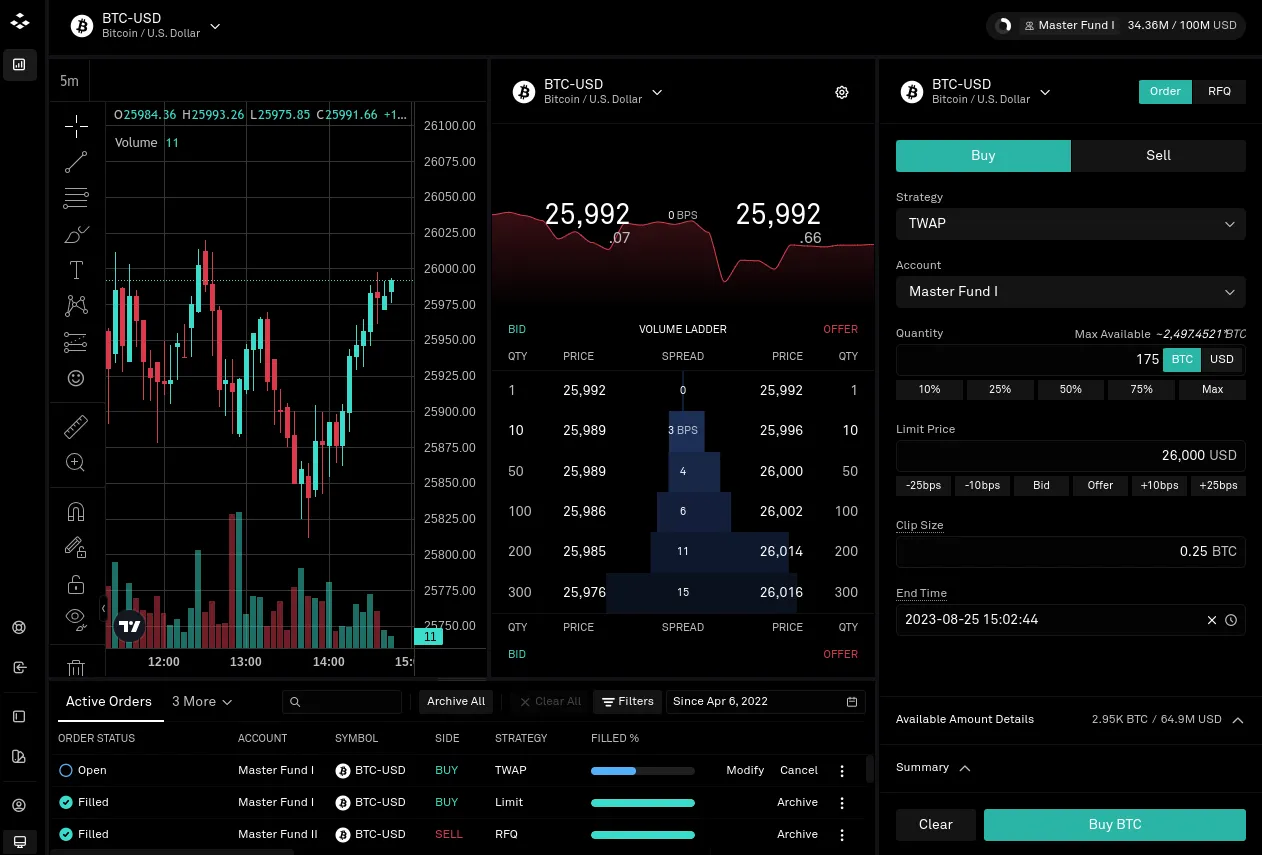

Designed to meet the complex needs of institutions, trade the way you want to with Cy Creek

Bank’s fully featured, self-service interface. With assets safeguarded by a federally chartered,

qualified custodian, trade securely through Cy Creek Bank’s agency trading desk—via API, the web

dashboard, or leverage our crypto-native traders 24/7/365 for complex trades.

Stay ahead of fast-evolving crypto markets

Get customizable access to crypto with a world-class digital asset platform for institutions.

Broad liquidity

Get full, diverse access to multiple liquidity sources from a single

onboarding and maintain tight pricing—even in the most difficult market conditions.

Smart order routing

Cy Creek Bank uses a smart order router to execute from leading

exchange and OTC providers.

Multiple order types

Choose from a wide range of order types, such as market, limit, stop

limit, benchmark targeting, RFQ, TWAP, iceberg, pegged,

and negotiated.

and negotiated.

Rapid settlement

Settle crypto and fiat quickly within secure custody and view

settlement status, improving trading efficiency.

Transparent fees

Agency pricing means we never pocket a spread and we never trade

against you.

A fully featured, self-service interface

Get the insights you need with trading history, settlement status, and limit usage data available in real time. Detailed transaction cost analysis may also be leveraged for insight into execution quality for algorithmic trades.

Trading with Cy Creek Bank vs. others

Scroll >>